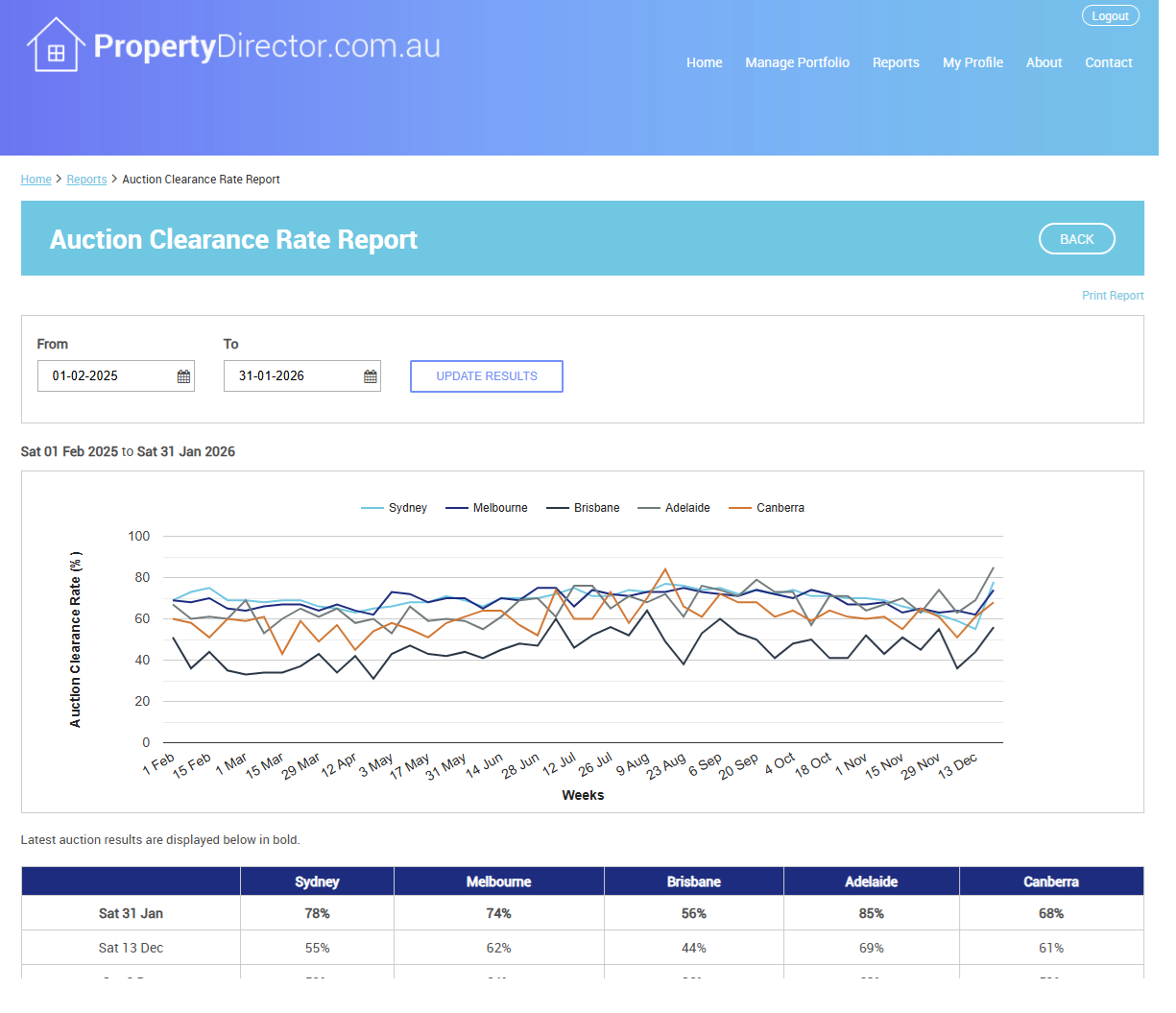

Auction clearance rates have started high off the mark for 2026. Sydney, Melbourne, and Adelaide are particularly strong.

SAT 31 JAN AUCTIONS

Sydney - 78%

Melbourne - 74%

Brisbane - 56%

Adelaide - 85%

Canberra - 68%

Do you think they will continue to stay this way for Q1 and Q2, based on the recent interest rate increase and current market?