As real estate investors ourselves, and having had the opportunity to meet many accomplished property investors, we have put together 10 quick tips to consider as part of your property investing strategy.

1. Start Early - there are many benefits to start investing early, but the biggest advantage is the fact you learn so much by just taking action.

2. Review Population Trends - population growth indicates that people are moving to the area, which means the area is likely developing and looking attractive to buyers. You should also consider population growth and migration/movement trends across different states and territories to help you pinpoint specific states to invest in.

3. Cater for a Wide Range of Demographics - purchasing real estate that is attractive to multiple buyers have greater potential for future capital growth.

4. Consider Interest Rates Environment - interest rates can have a significant impact on the overall cashflow health of your investment. If interest rates are currently low, you should always consider the impact of higher interest rates and the impact it will have to your portfolio.

5. Review Infrastructure and Facilities in area - find out about the available and planned infrastructure and facilities in the area such as schools, hospitals, shopping centres, and transport links.

6. Cashflow and Rental Yield - you should know the estimated rental income, expenses, and loan repayments associated with any property you wish to purchase. You should balance positive cashflow with the need for your investment to have sufficient capital growth potential. Use a professional digital bookkeeping platform such as PropertyDirector to stay organised and keep on track of your portfolio.

7. Review Vacancy Rates - rental vacancy rates indicate the level of rental demand in the postcode or suburb you intend to purchase in.

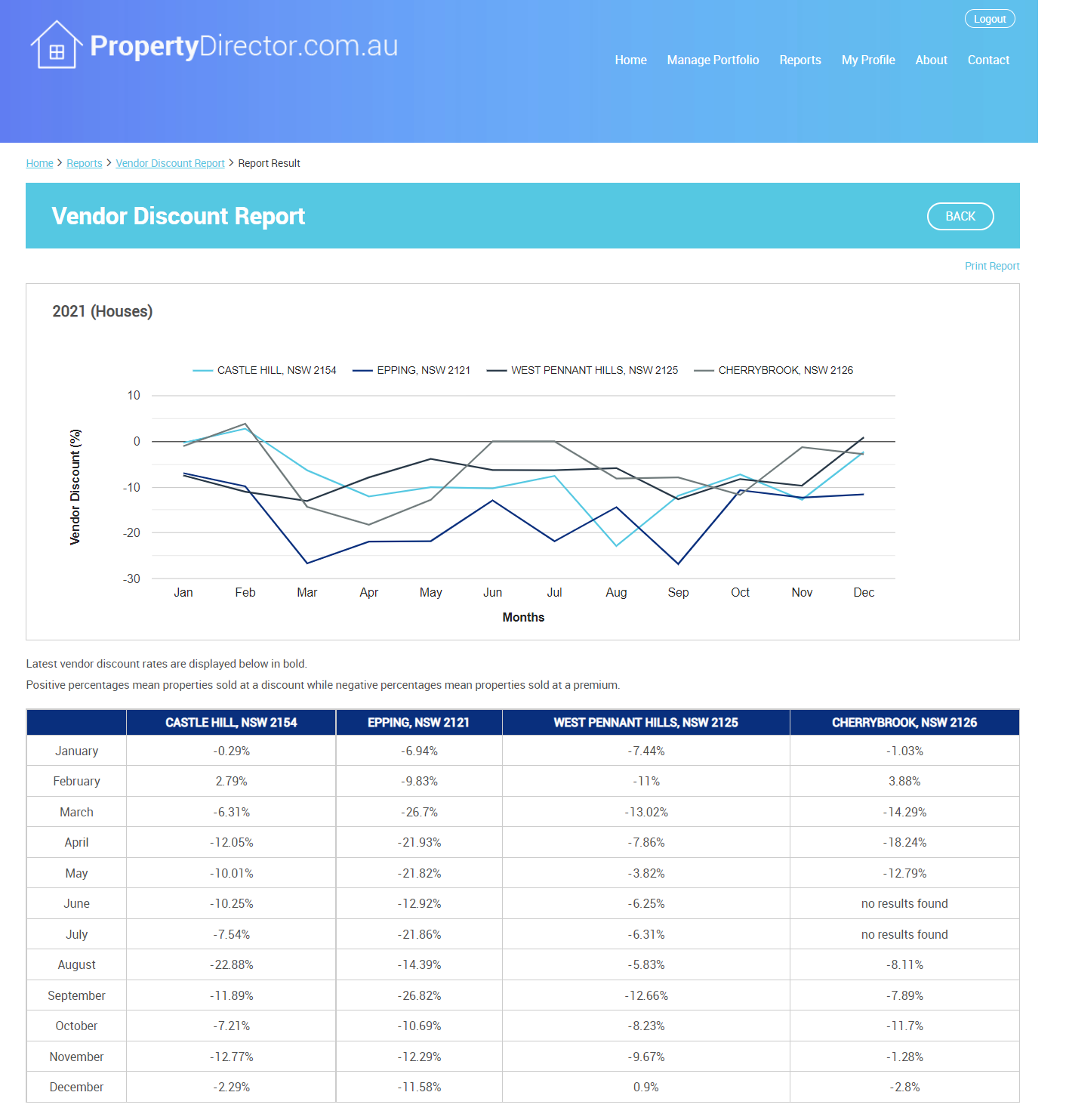

8. Days on Market and Vendor Discount Rates - days on market tells you how long real estate is staying on the market in a particular suburb. Vendor discount rates tell you how much of a discount properties are being sold for. See below for an example of vendor discount rates for 4 suburbs using PropertyDirector during 2021 - it's important to review not just the latest data but also trends over a number of months - as you can see below, last year was a boom year so vendor discount rates were generally negative (i.e. real estate was selling as premium prices).

9. Negotiate hard - once you make a decision based on research and data, take action by making an offer and negotiate hard to get the best price you can.

10. Play the long term game - real estate should be seen as a long term investment, so it's important to take time to do the correct due diligence and research to find the right properties in the right locations to purchase investments that provide the greatest long term capital growth and cashflow opportunities