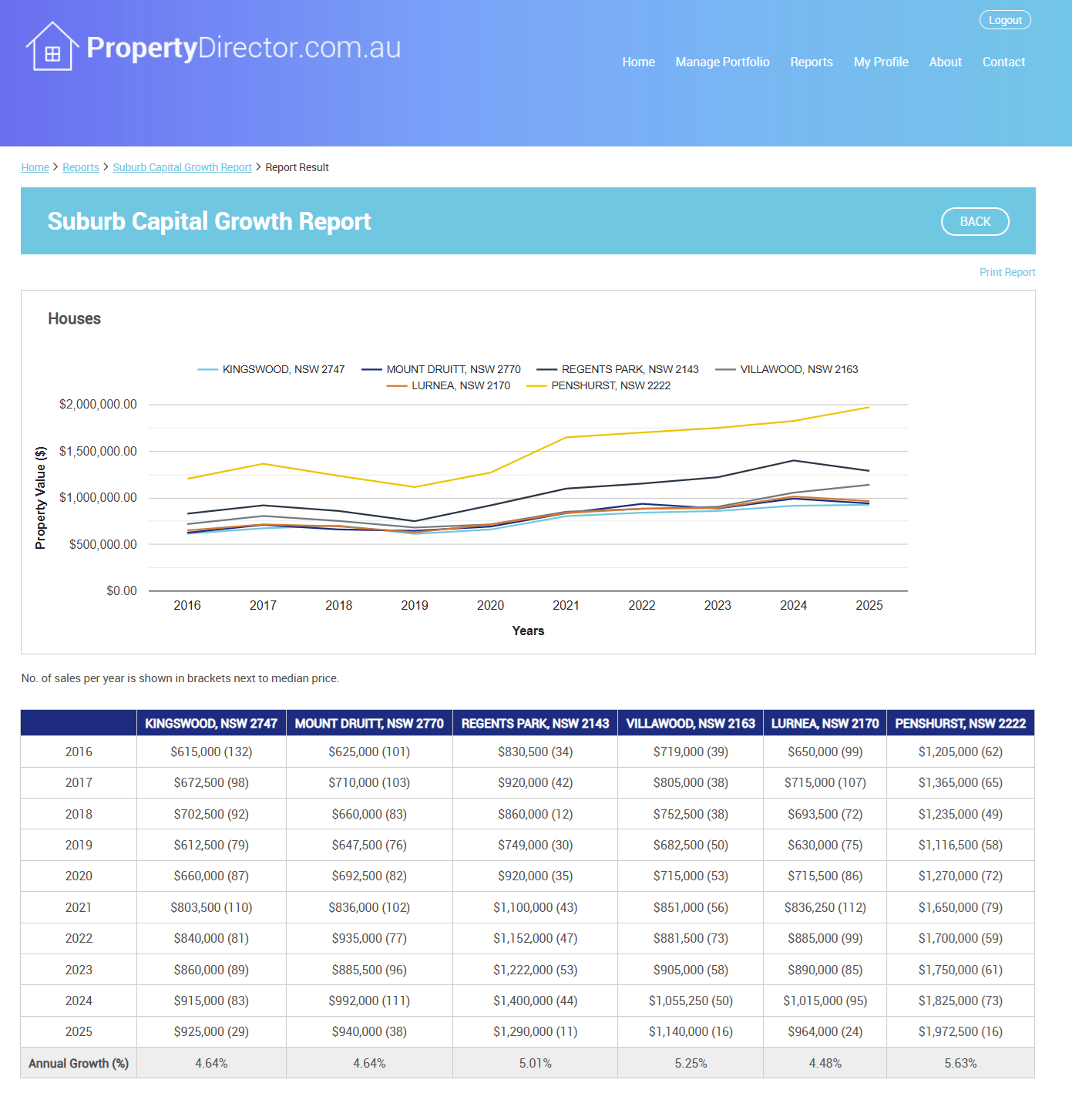

With Sydney house prices continually rising, many investors are steering clear and looking at other popular investment hotspots including Perth, Melbourne, and Brisbane.

On that note we thought we would put the lens on Sydney, based on 10 key suburbs identified by Canstar in their article here - https://www.canstar.com.au/home-loans/best-suburbs-sydney/

We've picked 6 suburbs from this list and performed a suburb analysis for each using PropertyDirector's tools.

While we feel the median purchase prices are a little high and the rental yields are lower than we'd like, we have done an analysis anyway.

KINGSWOOD

Median Price - $925,000

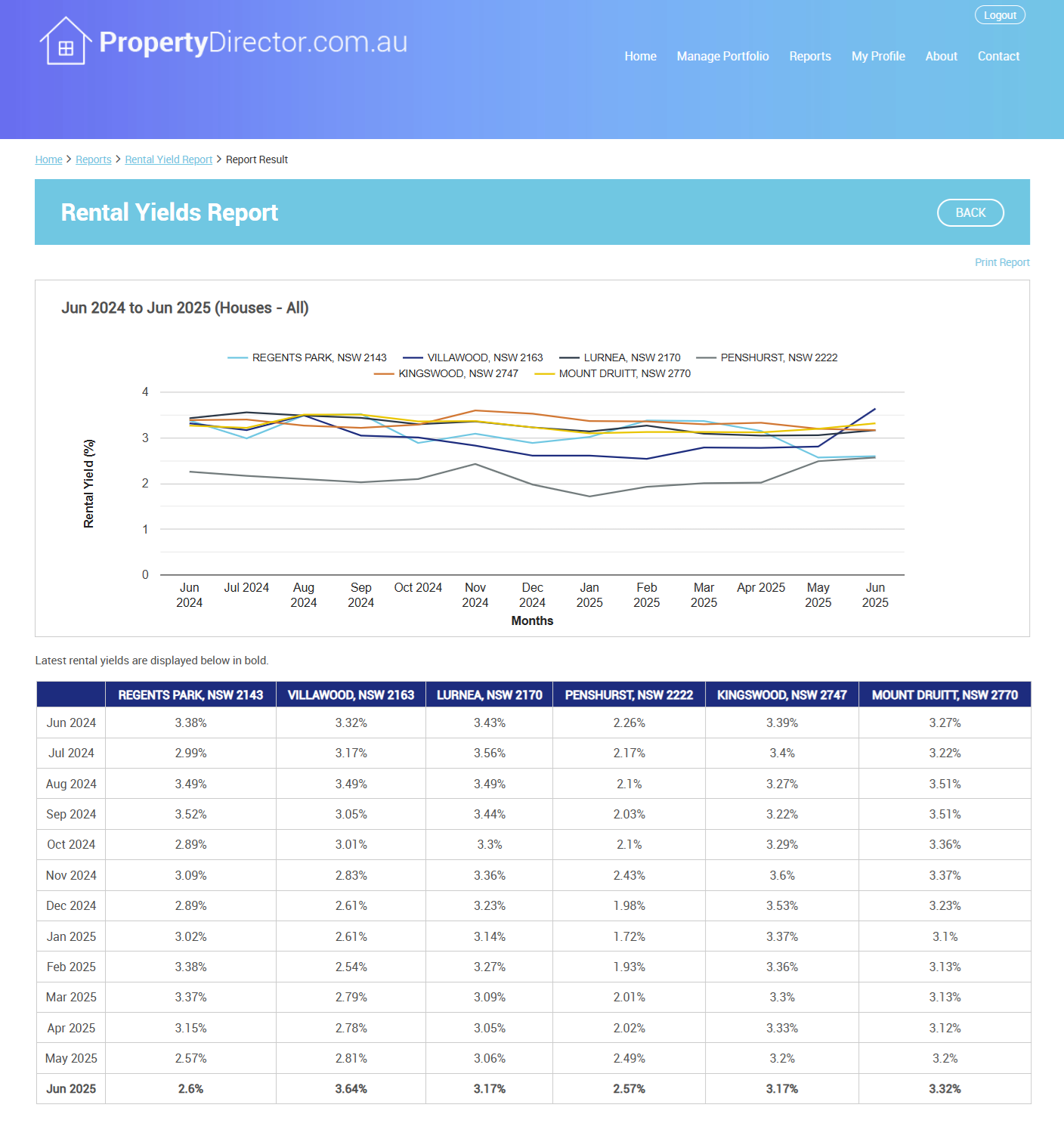

Rental Yield - 3.17%

Vacancy Rate - 1.27%

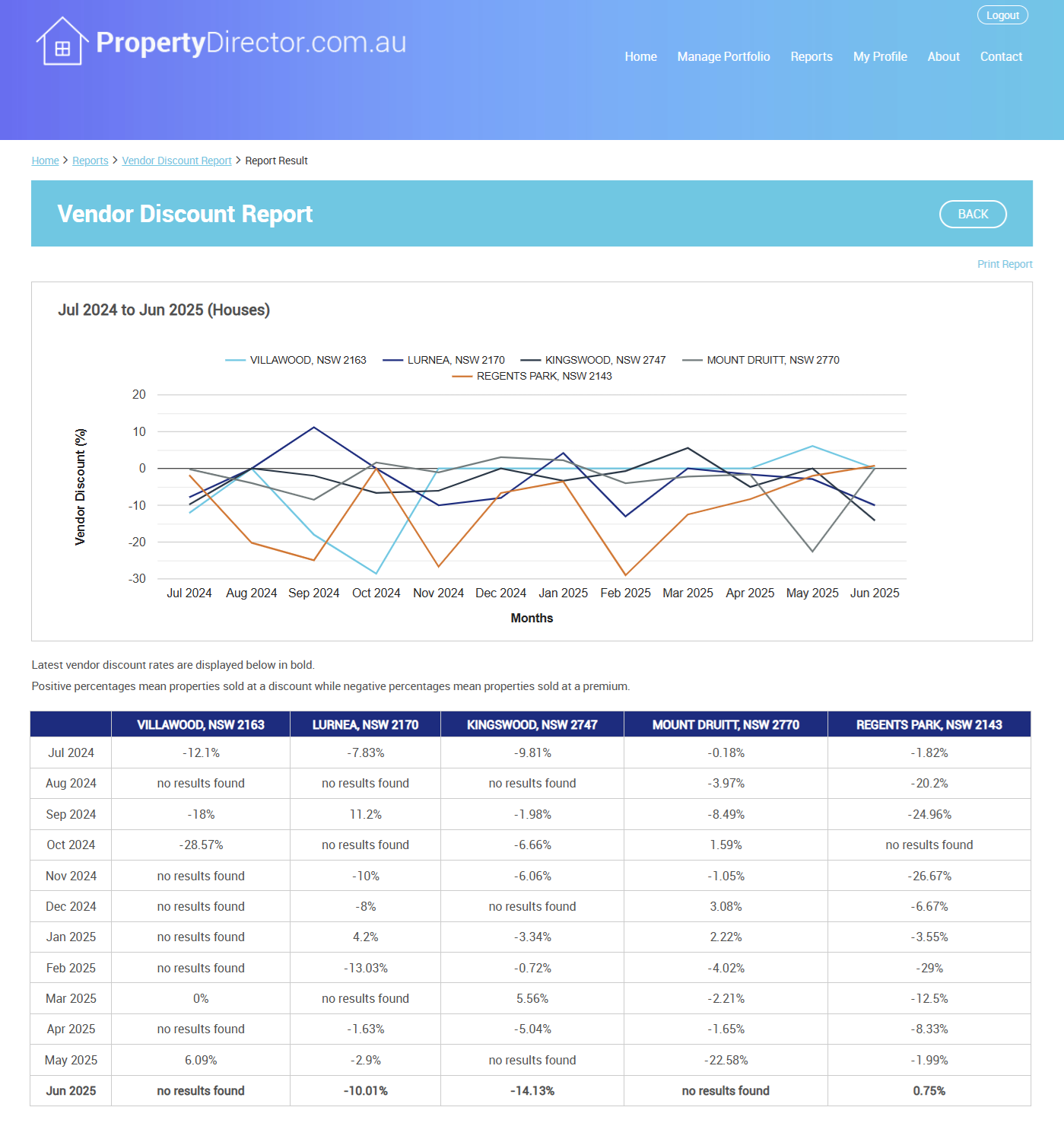

Vendor Discount Rate - properties are selling at 14%+ premium

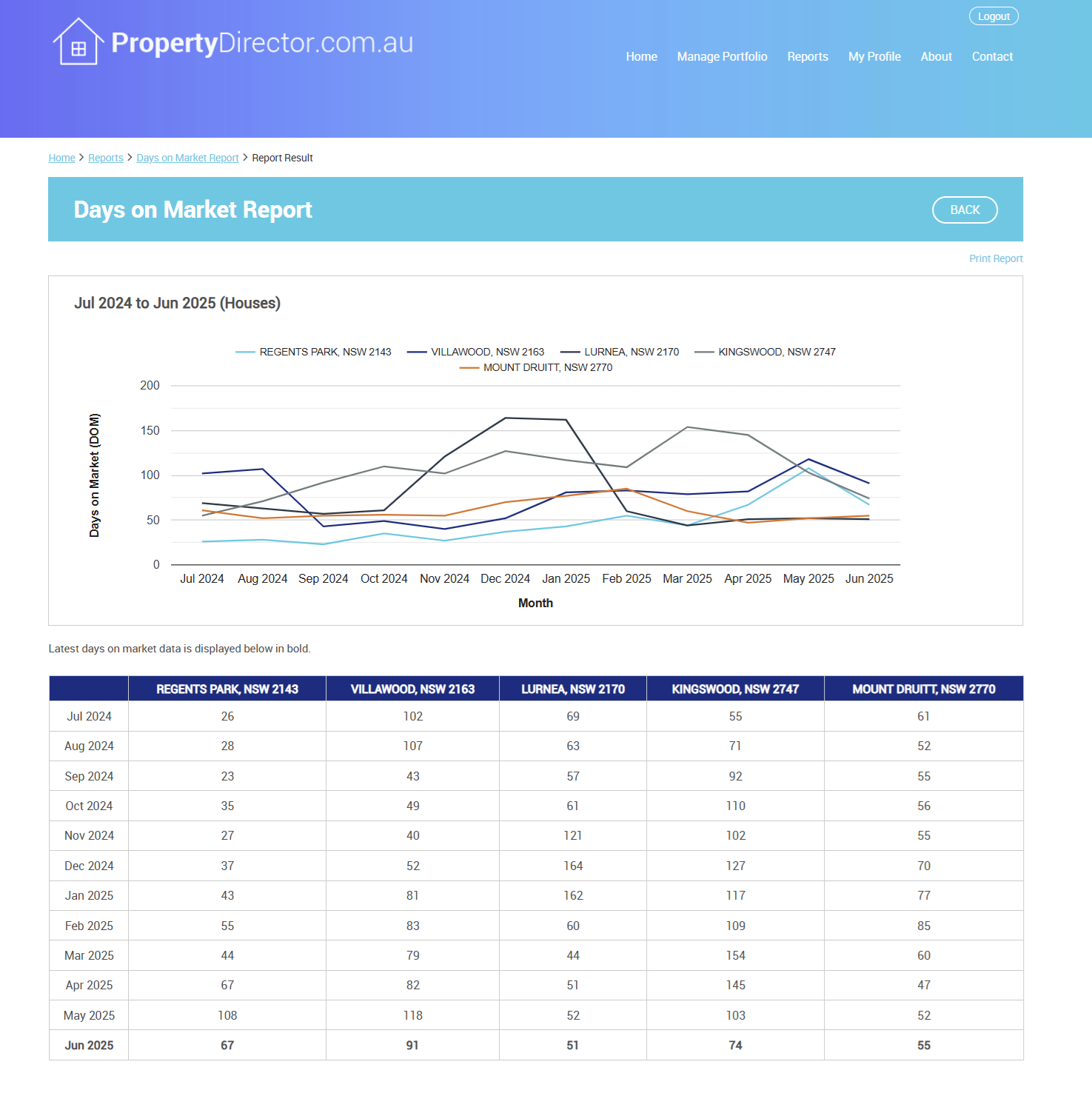

Days on Market - 74

Notes - with the multi-billion dollar investment in the new Western Sydney airport and corresponding infrastructure, Kingswood is very well placed and poised for growth. With university campuses and schools and facilities nearby, it provides a range of benefits.

MOUNT DRUITT

Median Price - $940,000

Rental Yield - 3.32%

Vacancy Rate - 0.68%

Vendor Discount Rate - properties are selling at 22%+ premium

Days on Market - 55

Notes - also in Western Sydney, Mount Druitt is well placed for growth with the massive infrastrucure investments occurring in the area. With Mount Druitt hospital, the major shopping centre, and TAFE and educational facilities nearby, the area is significantly gentrifying. Tight rental stock however rental yields could be better - Mount Druitt may be a good investment if you can find something at a discounted price for great value.

REGENTS PARK

Median Price - $1,290,000

Rental Yield - 2.6%

Vacancy Rate - 0.81%

Vendor Discount Rate - properties are selling at roughly the same as the listed price.

Days on Market - 67

Notes - in the Cumberland area not far from Parramatta with solid transport links. There's a reason the area has seen solid capital growth in recent years, maintaining a whopping 14% annual (compounded) growth over the last 5 years. If you pick up a bargain price, it could be worth investing here but you will need to hold on with the negative cashflow for a long time.

VILLAWOOD

Median Price - $1,140,000

Rental Yield - 3.64%

Vacancy Rate - 1.04%

Vendor Discount Rate - properties are selling at a discount of 6% compared to list prices

Days on Market - 91

Notes - with consistent buyer demand and good rental demand and facilities within the Canterbury-Bankstown LGA, Villawood is well priced and could be a good long term hold for those wishing to invest in a residential area that has seen improvements in recent years.

LURNEA

Median Price - $946,000

Rental Yield - 3.17%

Vacancy Rate - 1.24%

Vendor Discount Rate - properties are selling at 10% premium

Days on Market - 51

Notes - with Liverpool CBD and its great facilities and transport links nearby, Lurnea offers great value at a median price below $1 million.