Today we are going to do a basic and quick review to demonstrate the impact of interest rate movements to an investor's bottom line.

So far this year (2025), we have had a 3 interest rate cuts of 0.25 basis points each. This equates to 0.75% in total in terms of interest rates impact.

Lets suppose Johnny Henchman of Sydney owns 5 IPs, with loan outstanding on each of these on average of $500k each, meaning his total debt currently is $2.5 million.

Prior to the 3 rate cuts, lets assume he was paying 6.9% interest across all of his loans, on an Interest-Only basis.

This means he was paying a total of $172,500 annually to the bank in interest repayments (0.069 * 2,500,000), which equates to interest repayments of $14,375 per month.

With the interest rate cuts, with banks passing on the same 0.75% reduction, this means Johnny's new interest rate will be 6.15%. This means his total repayments would be $153,750 annually (0.0615 * 2,500,000), which equals $12,812.50 in monthly repayments.

As you can see above, the rates cutes in 2025 to date means Johnny is now saving $1,562.50 in monthly costs - showing the critical impact that interest rates have on an investor's overall borrowing capacity and financial health.

Don't forget to keep these basic concepts in mind as you grow and scale your portfolio, taking all key scenarios meaningfully into account! Register to our free 7-day trial here to add properties to your portfolio and use our easy-to-use forecasting tool to note your equity and financial position quickly - https://www.propertydirector.com.au/free-trial

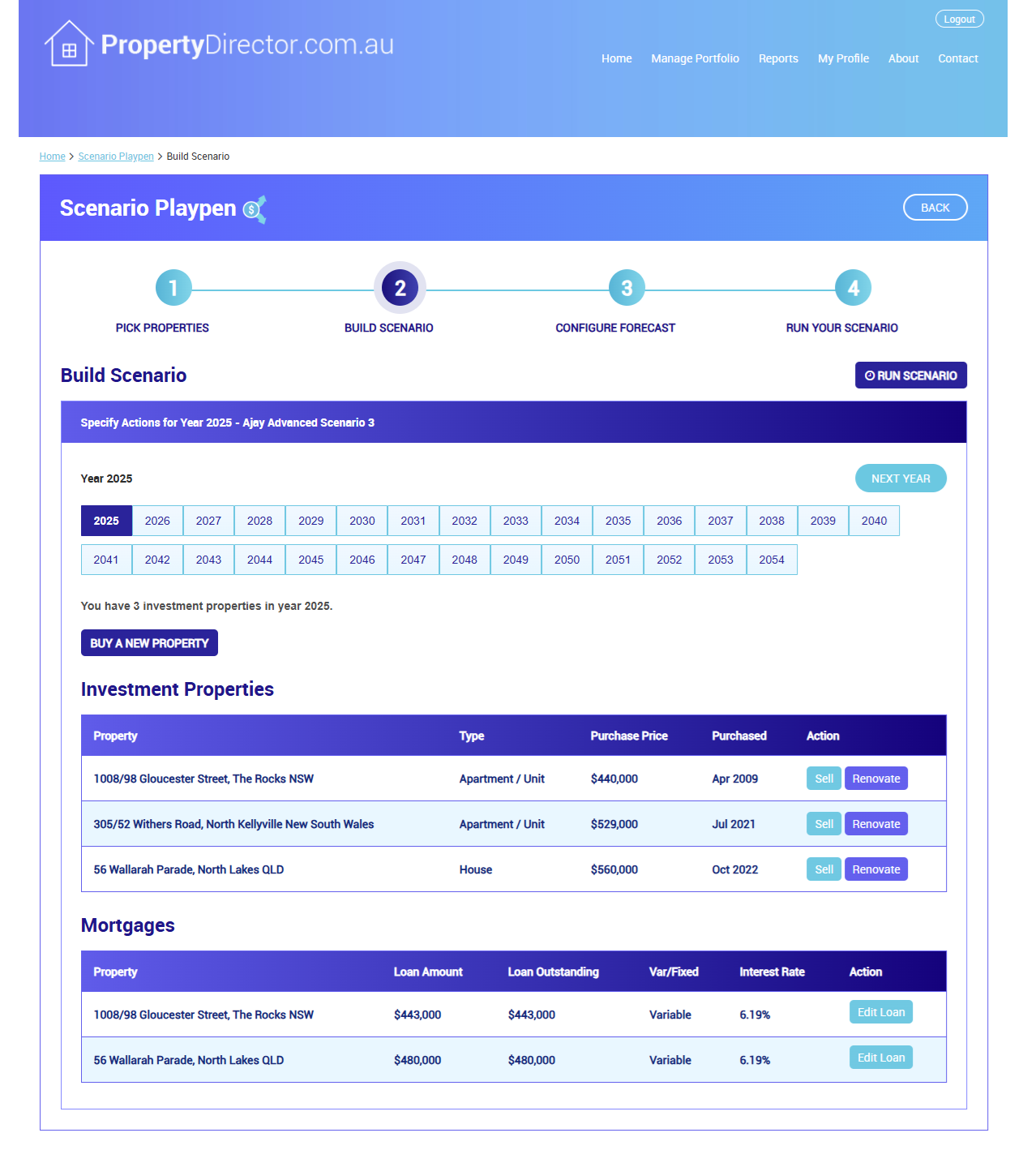

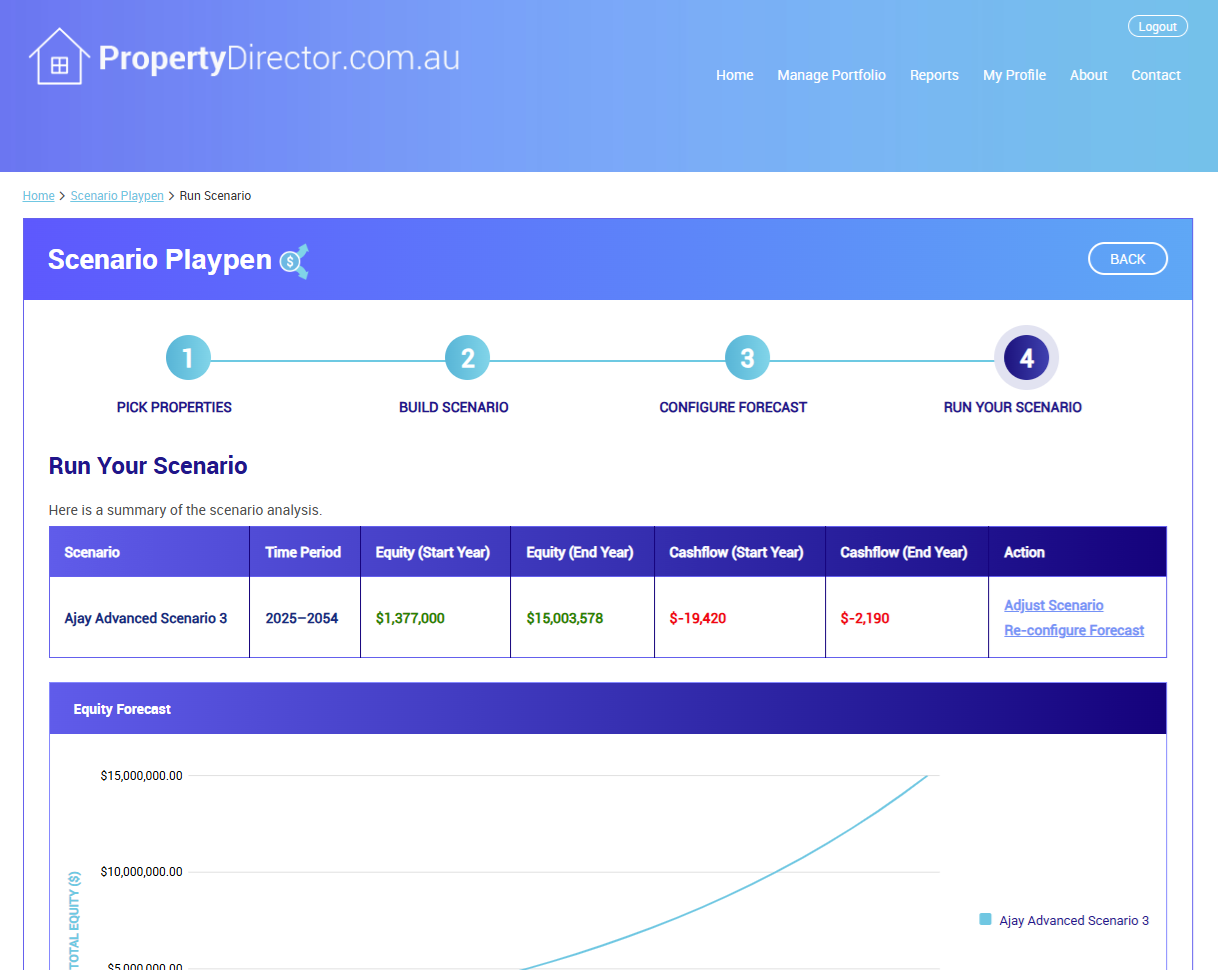

Soon we are launching the Scenario Playpen, an advanced scenario forecasting system enabling you to play out multiple property investment scenarios over a 30-year period! Below is a sneak peak.